Easiest Online Survey Creator

Easily create surveys & questionnaires, reach audiences on any device and view results in real-time.

✅ No credit card required ✅ All features included ✅ Book a demo

A survey creator trusted by over 100,000+ customers!

Getting accurate data and actionable insights for leading brands!

Use Fynzo survey creator just the way you want!

Create personalized surveys with Fynzo online survey creator. Browse through the vast collection of ready-to-use survey templates and customize it as per your requirements!

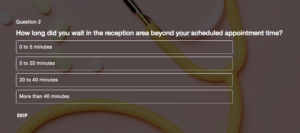

Easily implement jump logic

Now respondents won't have to skip irrelevant questions because with this feature - they won't see it in the first place!

Personalize your survey

Put your company's logo and customise your background image with the design tool on Fynzo's free online survey creator.

Select from 20+ question types

Select the question types which best suits your need. Fynzo online free survey creator also provides location & audio recording type questions.

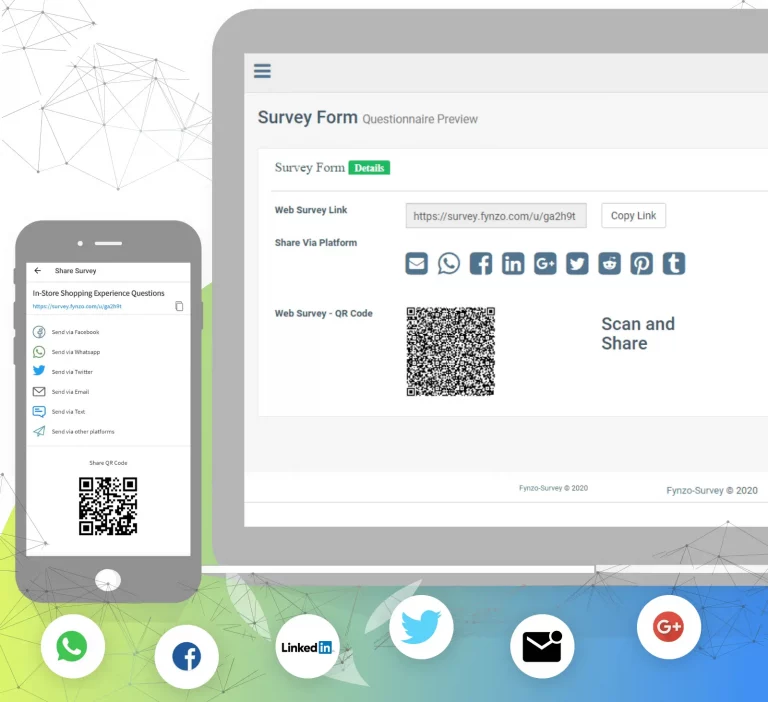

Distribute surveys to get quality responses

Circulate the surveys you created with this online survey creator. Distribute it among your target audience via different channels.

- Embed surveys on website

- Share surveys on social media channels

- Share surveys via email

- Share surveys on WhatsApp

- Share surveys via SMS

- Reach repondents with QR code

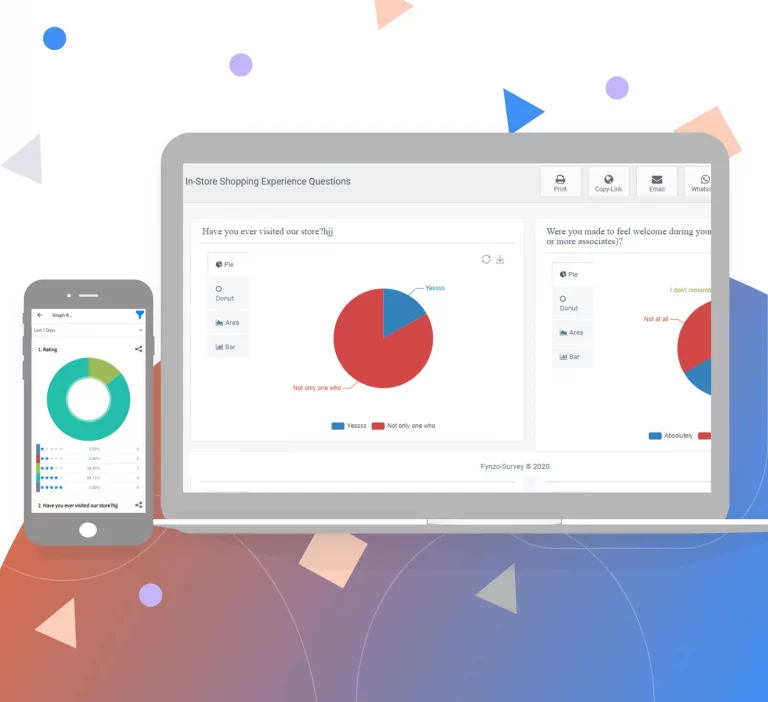

Analyze Survey Results

Now you can receive insighful real-time reports for all your survey types. View powerful statistical reports in rich graphical formats with the help of this online survey creator.

Export Reports

Download survey results in multiple-formats like XLSX, PDF, SPSS from Fynzo's free survey creator.

Share Reports

Share your real-time survey results and encourage your staffs & teammates to take action.

Schedule Reports on emails

Receive timely data by scheduling your survey reports on multiple emails.

Automate your workflow with multiple integrations

With Fynzo online survey creator, you have the option of easy integration with your favorite apps to automate your workflow.

- Fynzo survey provides data integration with standard apps like Google Analytics, Google Sheets, etc.

- Automate your workflow easily with integrations with apps like Zapier, Slack, etc.

- Use Webhooks to connect to your desired apps and process thee received data just the way you want.

Fynzo Online Survey Maker Exclusive Features!

Enhance your survey creation experience with Fynzo Survey’s unique offerings.

Available on Mobile & Web

Create a survey, distribute it to audiences, and analyze results on multiple platforms anytime, anywhere. Collect responses with the App even without the internet only through Fynzo online survey maker.

Easily implement jump logic

With Fynzo Survey's jump logic feature, you can draft smarter questionnaires. Increase the response rates by asking more personalized questions from your respondents, skipping irrelevant ones based on the previous responses.

24 X 7 Support

Stuck with something? Have a quick question? Fynzo's awesome support teams are available round the clock to answer any questions you may have regarding this survey maker. What are you waiting for? Ask away!

500+ Survey Templates

Enjoy the vast collection of survey templates available on Fynzo online survey maker. Select the template which best suits your need & complete your survey building process within few minutes.

100% Secure Data

Data security and privacy is a topmost priority for us at Fynzo. With Fynzo online survey maker, you get top-notch end-to-end security as well as privacy in accordance with GDPR and other such privacy policies.

Easy Integrations

Integrate easily with the apps you love: Google Sheets, Slack, Google Analytics, Facebook Pixel, Zapier, etc. With Fynzo online survey maker, create surveys that automate workflow and ease your decision-making.

Some badges of honor received.

Essential Tips On Creating Surveys That Deliver

Keep it short

Focus on the main goal of your survey while composing the questions on this survey maker. Include only those questions which are absolutely necessary. Keep it short, simple, and to the point.

Provide incentives

Adding gift cards, discounts and many other benefits will make your customers take up your survey. Make sure that the reward is of significance to the target age group.

Make it sound personal

Try adding a personal touch to your survey invite by mentioning the respondent's first name. It makes your receiver feel more acknowledged and they would take out some time to read what the company has to say.

Offer a survey through multiple channels

With Fynzo online survey maker, you can broadcast your surveys via email & texts. Try attaching your surveys on your social media sites or embed them into various marketing pages to remind your audiences to fill it up.

Send notifications

Notify your target audience by enabling email or SMS notifications on this free online survey maker. Convince them that their opinions matter to you. If they feel appreciated they would surely want to fill up your surveys.

Pay attention to the survey’s design

Design your survey according to your target age group. You can add a progress bar from which your respondents will know how much longer it will take for them to finish the survey.

One Survey Maker - Multiple Solutions!

Fynzo Survey’s customized solutions pave the path for the ultimate survey building experience

Healthcare

Send out hospital surveys and patient feedback forms to meet the fast-paced needs of the healthcare industry. Schedule appointments, monitor progress of your patients and maintain patient data in one place for better healthcare outcomes.

Retail

Increase your customer retention rates and brand recognition by sending out customer satisfaction surveys. Gather powerful insights on your service and products and strive towards an overall brand improvement with this free online survey maker.

Market Research

Explore and analyze your target market for making impactful decisions. Figure out where you stand in comparison to your competitors and keep up with the ever changing needs of your customers with this free online survey maker.

Hospitality & Travels

Deliver a world class holiday experience that your customers will never forget with the help of clients satisfaction surveys and online reviews. Get to know their preferences better.

Education

Encourage student and teacher feedback for improved educational outcomes. Access the quality of your employees frequently and boost your student engagement rates with Fynzo survey maker.

Event Planning

Ensure the success of your event by getting to know your attendees expectations before hand. Gather insightful feedback from your guests post-event and maintain your brand image.

Fynzo free online survey creator brings several pre-designed survey templates to start with

Customer Survey

Get customer feedback through the questions in the templates that let customers give their views by rating the different aspects of the store.

Hospital Survey

This questionnaire creator also comes with a hospital feedback template asking patients about the hospital’s medicine, doctors, and service.

Restaurant Customer Survey

Restaurant customer feedback forms are the ones that collect feedback on food quality, ambience of the restaurant, and more.

Hotel Guest Survey

There are a lot of aspects of hotel services on which feedback can be collected from guests at the hotel.

Automobile Cleaning Survey

This template on the questionnaire creator concerns servicing of automobiles of the customers.

Salon Customer Survey

Using the questionnaire creator, customers can be asked for feedback on services offered by the salon.

Create surveys online using the Fynzo survey creator app

Easily create surveys of your own, distribute them, collect responses and analyze them in rich graphical formats, all on Fynzo online survey app.

- Create surveys in your native language

- Customize your survey by adding logo and background image

- Modify surveys and collect responses even in offline mode

- Available on Android

Frequently Asked Questions on Survey Creator

To collect insightful feedback from your customers, online survey creator software is the best option for you. Here actionable data is collected with the help of online surveys or forms. Most online survey creators provides a collection of readymade templates that can be used to create surveys in a short span of time.

From traditional research methods like typing out questions on a document and asking people to fill them out, the online survey creator has evolved a lot. They are faster and take less time to create. Online questionnaires are a cheaper alternative, easy to analyze, and more accurate. It also increases your survey completion rates as it becomes easier for your customers to fill out.

Fynzo Free Online Survey Creator is not just a survey creator but an exclusive survey experience. It’s an advanced yet simple tool which helps you build personalized surveys in minutes. This online survey creator comes with powerful features like skip logic, ready-made survey templates, themes and many more. You gather actionable insights by sharing survey on every possible device. Data security is the topmost priority of Fynzo and with this survey creator, you don’t need to think twice about data collection from customers all over the globe.

With Fynzo Free Online Survey Creator you can easily create surveys in a matter of a few minutes. This is because of the presence of many survey templates, question types, advanced features, and customization options. Create online surveys just the way you want and share them through multiple channels like social media, email, SMS, or even via QR codes. After receiving feedback you can even analyze the responses with the help of reports and download them in multiple formats.

Just follow these simple steps:

1. Login to your very own Fynzo account.

2. Click on “Create New Survey” on the dashboard.

3. Enter a Form Name of your choice and press submit.

4. Click on “Add New Questions” to add a question to the survey.

5. Mix and match the type of questions like MCQ, NPS ranking, text, etc. according to your needs.

6. Flip over the “Required” button if the question is compulsory.

7. Submit your form to save the question.

8. Add more questions on the subsequent page.

9. After you are done adding questions, share your survey on social media channels, by email, SMS, or through QR codes.

You can enjoy a 14-day trial on Fynzo online survey maker free of cost, where no credit card information is required. Apart from that, its paid plans, are:

Monthly subscription:

- Starter plan- $24/month

- Standard plan- $45/month

- Premium- $95/month

Yearly subscription:

- Starter plan- $19/month

- Standard plan- $32/month

- Premium- $79/month

View full pricing here.

Yes, you need to have an account for creating surveys here. Sign up with your Gmail, Facebook or via email to enjoy the advanced survey experience offered by Fynzo online survey builder.

Yes, pictures and videos can be added to the question along with text. Many such customization options are available with Fynzo online survey builder.

Yes, of course. After you finish creating your survey, you can preview it by opening the survey url in browser. You can make changes to your surveys if you don’t like what you are seeing.

What people say about us

Tips and Tricks on Survey Creator

7 Best Survey Incentive Ideas for Higher Response Rate

Is it that you don’t get enough responses even though you draft the survey well, send it to your respondents at the perfect time, share it on social media, etc?

Writing Survey Questions

We are all aware of how significant survey questionnaires are to research since they enable experts to gather pertinent data swiftly and efficiently. Are you interested in learning how to write the greatest survey questions, then? If so, this article is for you.

What Is The Best Time To Send A Survey?

We all know that in this day and age, we all need technology. It’s almost as if our lives have become easier. Then, time is another important factor. There are

How to create online surveys?

Market researchers are often in the need of powerful online survey software to create surveys easily and spread them in their network. Nowadays, advanced survey builders provide solutions to create